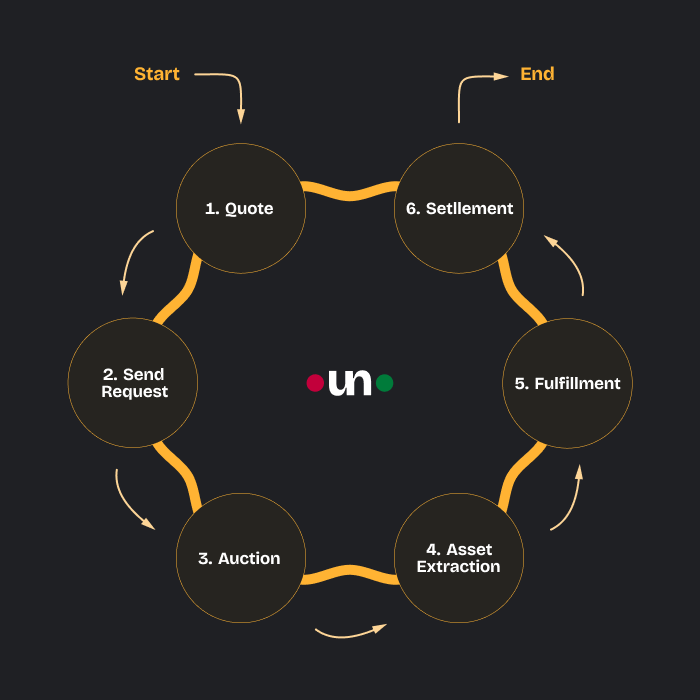

Request Lifecycle

Overview

The Bungee Auto Mode is a request based execution with off-chain signatures designed to execute same chain and cross-chain swaps. When you want to swap tokens across chains, the protocol breaks down this intent into a series of steps, each optimized for security, efficiency, and best execution.

For same chain swaps, the protocol executes the swap directly on the source chain. The steps for same chain swaps are much simpler as the swap is performed directly on the source chain atomically.

For cross-chain swaps, the protocol performs the following steps:

Stage Details

1. Quote Generation

| Purpose | Before committing to a swap, get an estimate of the output amount |

|---|---|

| How it Works | • Uses the Quoting Engine to check prices and liquidity • Returns a quote with execution details • Final execution price is determined during the auction phase, where off-chain agents compete to execute your request |

2. Request Creation

| Purpose | Submit your swap request in a secure and cost-effective way |

|---|---|

| How it Works | • Specify source token, destination token, and parameters • Create request either offchain (ERC20) or onchain (any token) • Uses Permit2 for gasless ERC20 approvals • Includes protection parameters like slippage |

Creating Requests

For ERC20 tokens, you have two options:

- Offchain: Create requests by signing messages using Permit2. This is gasless and only requires a one-time on-chain approval.

- Onchain: Place requests directly through smart contracts, which requires gas fees.

For native tokens, requests must be created onchain through smart contract transactions, which always require gas fees and are secured by blockchain consensus.

3. Auction

| Purpose | Select the best executor based on price and reliability |

|---|---|

| How it Works | • Request enters Bungee's auction house • off-chain agents analyze and bid on the request • Best bid wins |

4. Asset Extraction

| Purpose | Lock the source tokens for the swap, guaranteeing the request's execution |

|---|---|

| How it Works | • Winning Transmitter uses your Permit2 approval • Extracts exact amount from request and may swap to an intermediate token if needed and permitted by user request • Assets locked in smart contract for the duration of the swap |

5. Fulfillment

| Purpose | Complete the token swap on the destination chain |

|---|---|

| How it Works | • Transmitter executes on destination chain • Performs swaps if needed • Must meet requirements set by user's request |

6. Settlement

| Purpose | Settle the request and unlock payment to the winning/executing off-chain agent |

|---|---|

| How it Works | • Verify successful token transfer on destination chain • Release locked token/stake • Emit settlement event and update relevant contract states |

Protection Mechanisms

| Protection Type | Conditions | Actions |

|---|---|---|

| Deadline Protection | If the request isn't executed by the deadline | • The request expires automatically • Extracted assets become refundable • Refunds can be triggered by anyone, but our backend handles this automatically |

| Slippage Protection | If market conditions change | • Execution reverts if it falls below the minimum threshold • Assets are returned to the smart contract • The request can be refunded and retried |

| Failed Execution | If execution fails | • Assets remain secure in the smart contract • A 3-hour settlement window begins • Refunds occur automatically after the window • Manual refunds are also supported |

Error Handling

| Error Stage | Conditions | Consequences |

|---|---|---|

| Before Asset Extraction | If error occurs | • Request remains valid • No assets at risk • Can be picked up by another transmitter • Expires at deadline if not executed |

| After Asset Extraction | If error occurs | • Assets locked in contract • 3-hour settlement window • Automatic refund system by our backend or anyone can trigger a refund |